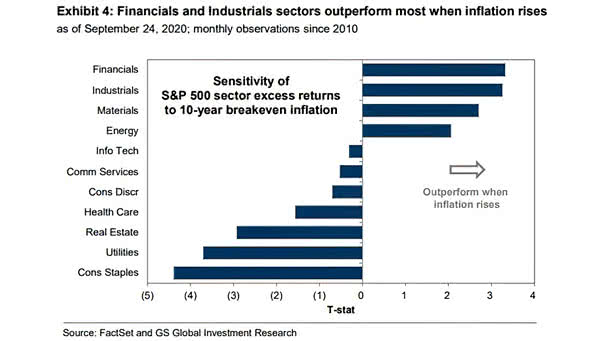

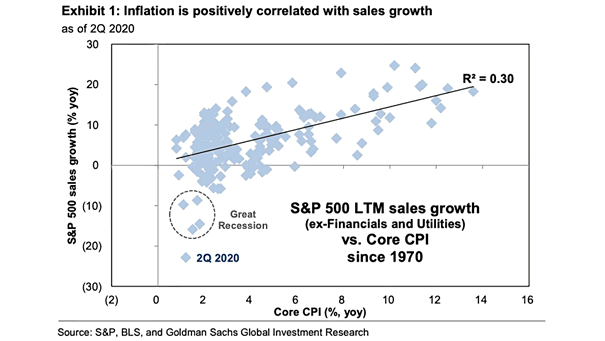

Sensitivity of S&P 500 Sector Excess Returns to 10-Year Breakeven Inflation

Sensitivity of S&P 500 Sector Excess Returns to 10-Year Breakeven Inflation Financials, industrials, materials and energy sectors outperform most when inflation rises. Image: Goldman Sachs Global Investment Research