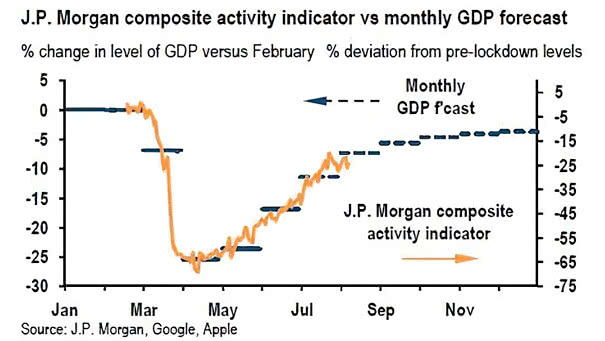

U.S. Composite Activity Indicator vs. Monthly U.S. GDP Forecast

U.S. Composite Activity Indicator vs. Monthly U.S. GDP Forecast The J.P. Morgan composite activity indicator has lined up with reported monthly GDP so far, as retail enjoys swift revival in sales. Image: J.P. Morgan