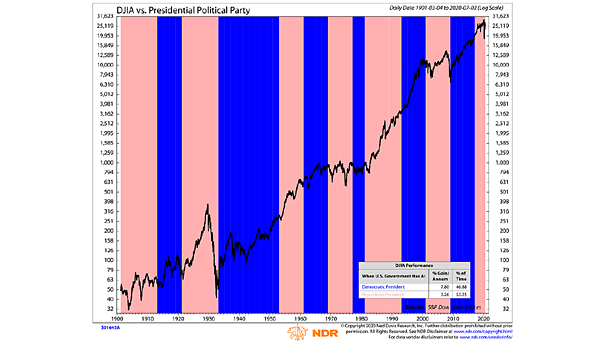

U.S. Elections – Dow Jones vs. Presidential Political Party

U.S. Elections – Dow Jones vs. Presidential Political Party Republicans vs. Democrats: this chart shows that Dow Jones returns have been much better when a Democrat held the presidency. Image: Ned Davis Research