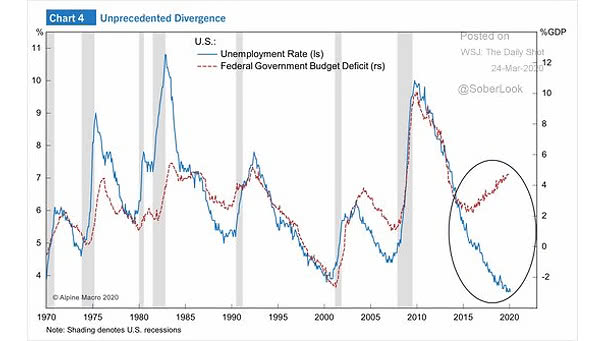

U.S. Unemployment Rate and U.S. Federal Government Budget Deficit

U.S. Unemployment Rate and U.S. Federal Government Budget Deficit This chart shows the unprecedented divergence between the U.S. unemployment rate and the U.S. federal government budget deficit. Image: Alpine Macro