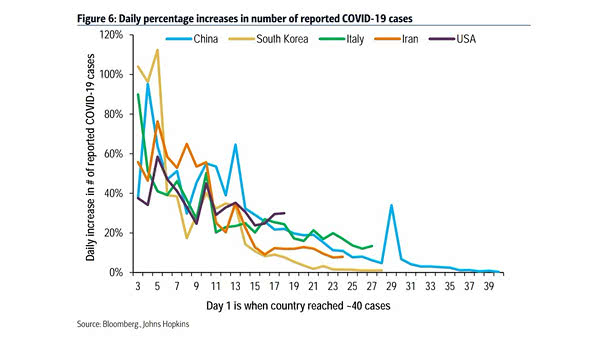

Daily Increases in Number of Reported Coronavirus Cases

Daily Increases in Number of Reported Coronavirus Cases The chart suggests that the initial phases of the coronavirus outbreaks appear to be relatively similar in China, Italy, South Korea and Iran. By Day 40 in…