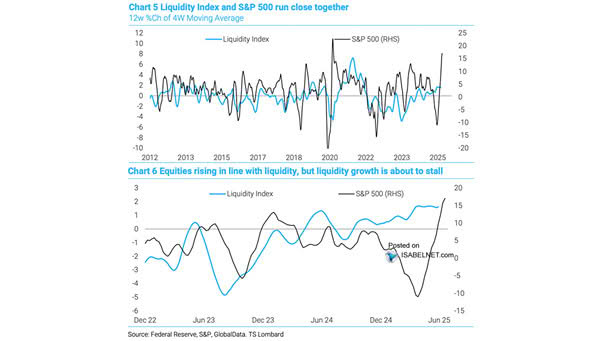

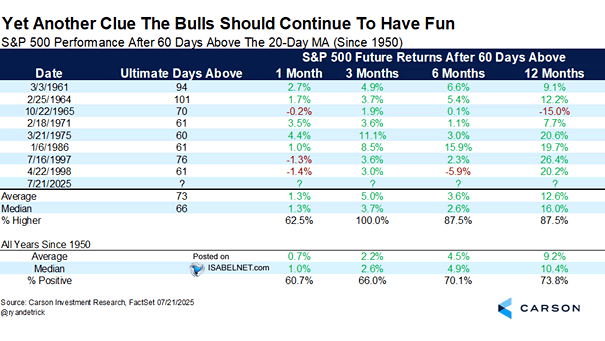

S&P 500 vs. Liquidity Index

S&P 500 vs. Liquidity Index A slowdown in liquidity growth—particularly if combined with soft economic data—poses a short-term risk to the U.S. equity market, increasing volatility and the likelihood of price declines. Image: TS Lombard