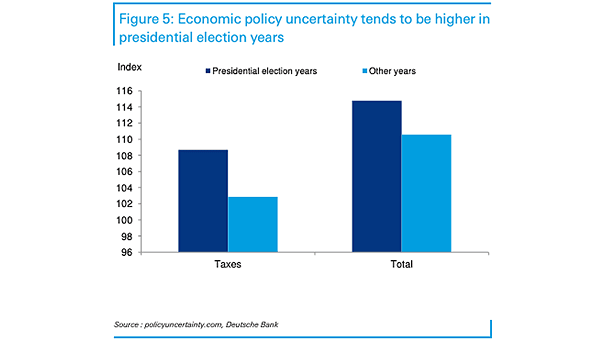

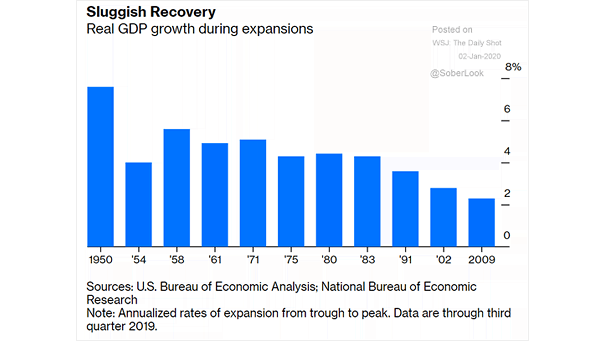

Economic Policy Uncertainty During U.S. Presidential Election Years

Economic Policy Uncertainty During U.S. Presidential Election Years Chart suggesting that historically, economic policy uncertainty is higher in U.S. presidential election years, particularly uncertainty related to tax policy. Image: Deutsche Bank