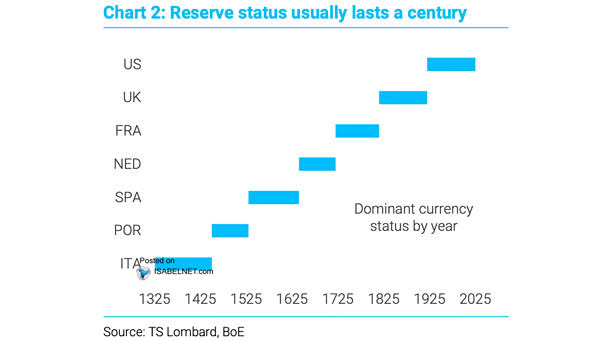

The U.S. Dollar and Reserve Status

The U.S. Dollar and Reserve Status Could the U.S. dollar lose its status as the world’s dominant reserve currency? Historically, leading reserve currencies have held their status for about a hundred years. Image: TS Lombard