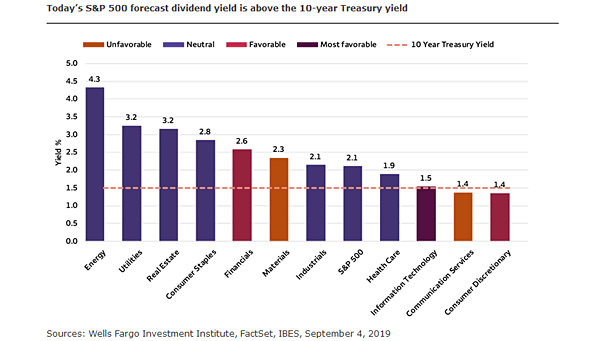

S&P 500 Forecast Dividend Yield Is Above The 10-Year Treasury Yield

S&P 500 Forecast Dividend Yield Is Above The 10-Year Treasury Yield Dividends remained stable or increased, while the 10-year Treasury yield has declined. Image: Wells Fargo Investment Institute