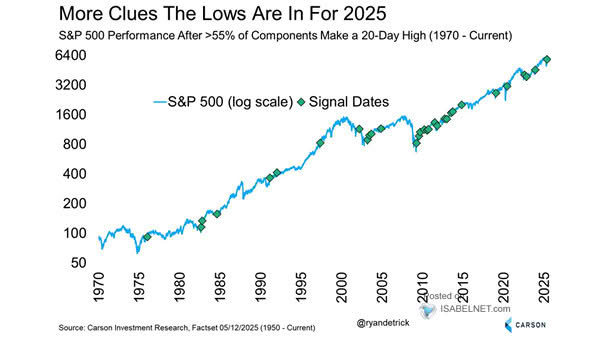

S&P 500 Index and 200-Day Moving Average

S&P 500 Index and 200-Day Moving Average Regaining the 200-day moving average is a constructive technical signal for the S&P 500 index, as forward returns tend to be positive more often than not. Image: Bloomberg