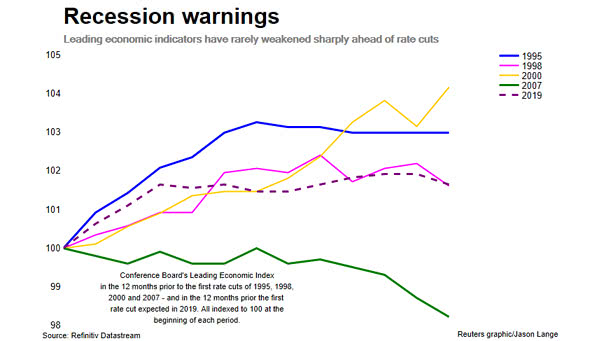

U.S. Leading Economic Indicators and Recession Warnings

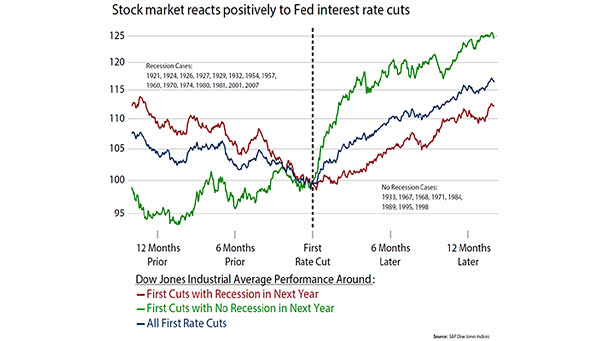

U.S. Leading Economic Indicators and Recession Warnings The Conference Board’s Leading Economic Index for the U.S. has rarely weakened sharply ahead of rate cuts, except in 2007. Currently, it doesn’t suggest that a recession is…