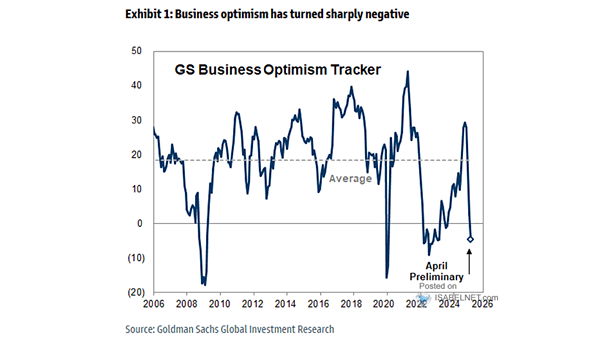

Sentiment – GS Business Optimism Tracker

Sentiment – GS Business Optimism Tracker U.S. business optimism has seen a significant and widespread decline in early 2025, as multiple indicators and surveys report sharp drops in sentiment among CEOs, CFOs, and small business…