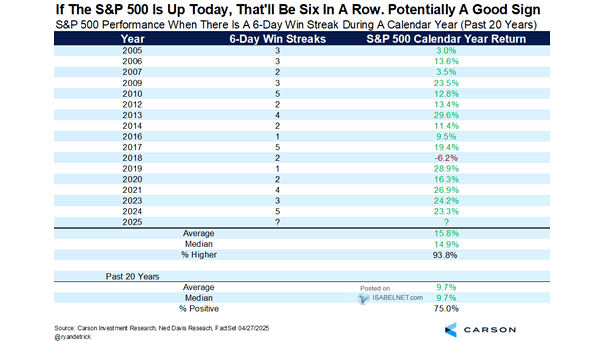

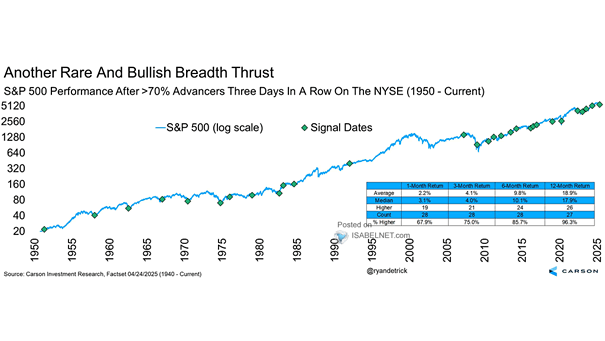

S&P 500 Performance When There is a 6-Day Win Streak During a Calendar Year

S&P 500 Performance When There is a 6-Day Win Streak During a Calendar Year Bulls once again have reason to smile: a six-day S&P 500 winning streak has preceded positive annual performance in 15 out…