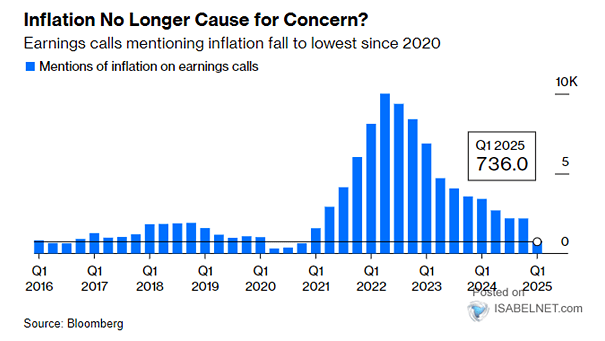

Inflation Mentions on Earnings Calls

Inflation Mentions on Earnings Calls Mentions of “inflation” during S&P 500 companies’ earnings calls have plummeted to their lowest levels in years, reflecting a shift in corporate concerns and economic conditions. Image: Bloomberg