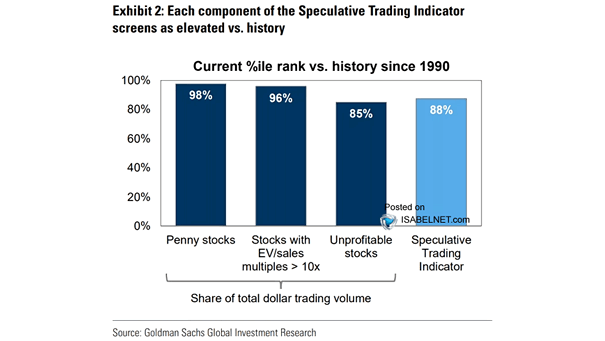

Each Component of the Speculative Trading Indicator Screens as Elevated vs. History

Each Component of the Speculative Trading Indicator Screens as Elevated vs. History All three core components of Goldman Sachs’s speculative trading indicator—unprofitable, penny, and high EV/sales stocks—are trading near the extreme upper deciles, reflecting a highly speculative market environment right now. Image: Goldman Sachs Global Investment Research