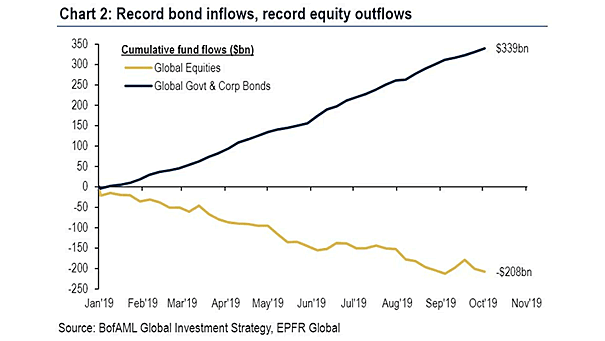

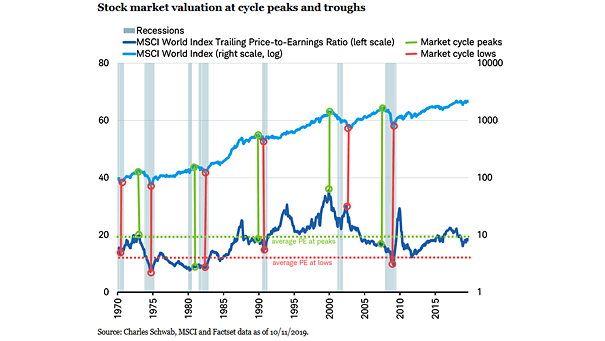

Cumulative Fund Flows: Global Equities and Global Government & Corporate Bonds

Cumulative Fund Flows: Global Equities and Global Government & Corporate Bonds $339 billion in inflows to bond funds globally, and $208 billion in outflows from global equity funds in 2019, as investors fear a global recession is on the horizon. Image: BofA Merrill Lynch