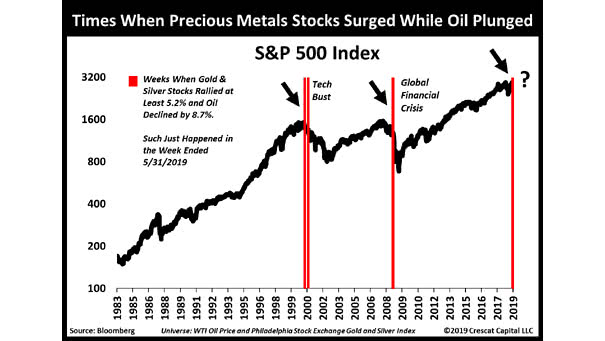

Times When Precious Metals Stocks Surged While Oil Plunged

Times When Precious Metals Stocks Surged While Oil Plunged This chart shows that precious metals stocks surged while oil plunged, only three other times in recent history. Image: Crescat Capital LLC