Dec

29

2025

Off

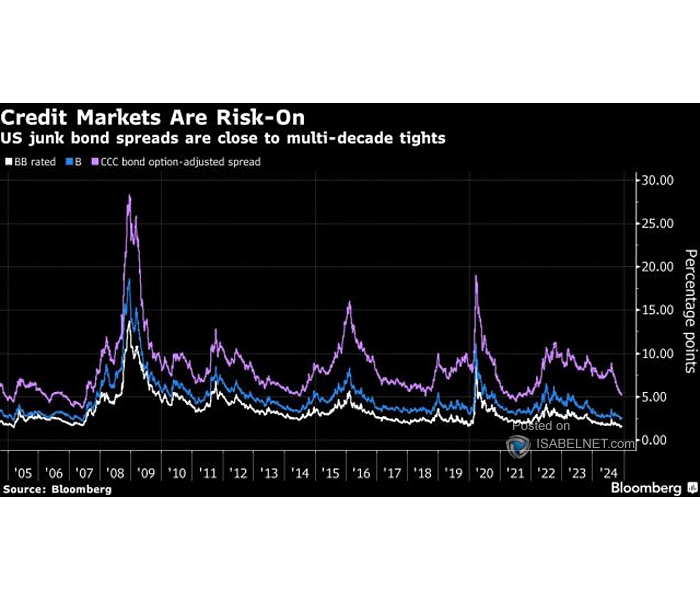

U.S. High-Yield Spreads vs. Corporate Cash Flow as % of Debt (Leading Indicator)

Rising AI infrastructure spending and swelling debt are draining liquidity, setting the stage for weaker cash-flow-to-debt ratios in 2026 and wider credit spreads across the sector.

Image: Bloomberg