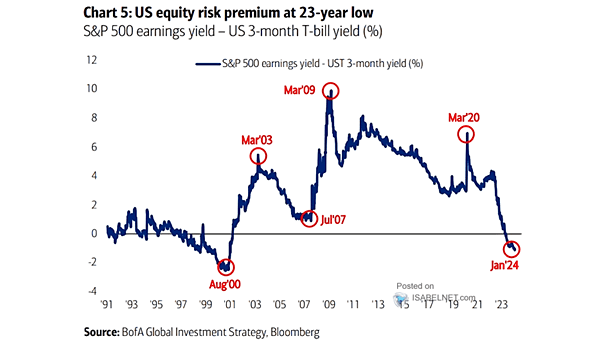

S&P 500 Earnings Yield – UST 3-Month Yield

S&P 500 Earnings Yield – UST 3-Month Yield Historically, when the cash yield exceeds the earnings yield, this is often seen as a headwind for equities, as investors tend to prefer allocating their funds to cash investments rather than stocks. Image: BofA Global Investment Strategy