S&P 500 Advance-Decline Line

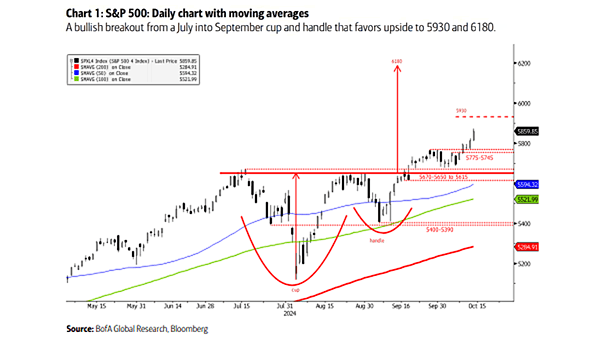

S&P 500 Advance-Decline Line The S&P 500 advance-decline line serves as an essential indicator of market trends and sentiment. When it hits an all-time high, it typically signals positive news for the U.S. stock market. Image: BofA Global Research