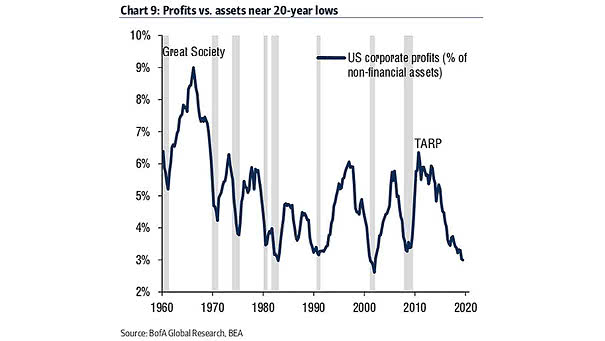

U.S. Corporate Profits vs. Assets

U.S. Corporate Profits vs. Assets U.S. corporate profits are near 20-year lows relative to fixed assets. The alternative to a recovery in corporate profits is the increasing risk of recession. Image: BofA Global Research