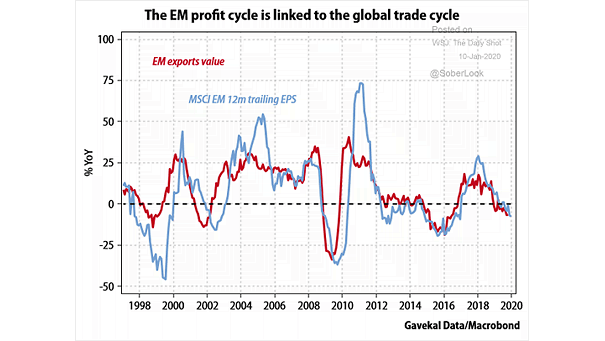

Emerging Markets Exports Value and MSCI Emerging Markets 12m Trailing EPS

Emerging Markets Exports Value and MSCI Emerging Markets 12m Trailing EPS Chart suggesting that EM corporate profits are linked to the global trade cycle. Image: Gavekal, Macrobond