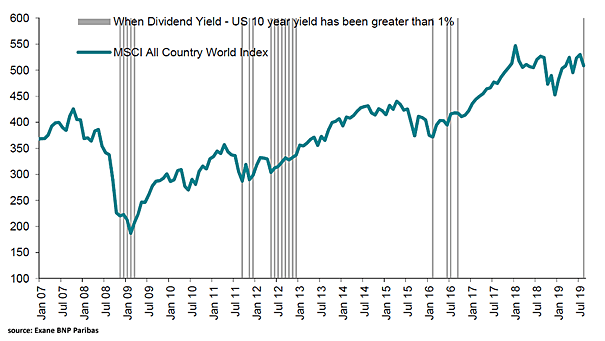

MSCI All Country World Index (ACWI) Dividend Yield Less U.S. 10-Year Yield

MSCI All Country World Index (ACWI) Dividend Yield Less U.S. 10-Year Yield When the spread has been greater than 1%, it has been a good support for the MSCI All Country World Index. Image: Exane BNP Paribas