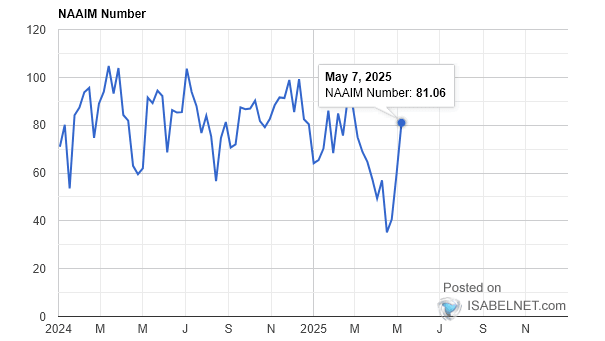

NAAIM Exposure Index – Investor Sentiment

NAAIM Exposure Index – Investor Sentiment The current 99.30 reading reflects active managers’ strong bullish stance and significant exposure to the U.S. stock market, signaling robust confidence but also caution for potential market volatility ahead. The National Association of Active Investment Managers Exposure Index represents the two-week moving average exposure to U.S. equity markets reported by NAAIM…