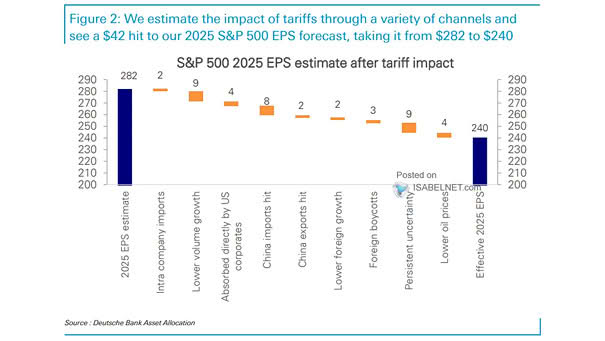

S&P 500 2025 EPS Estimate After Tariff Impact

S&P 500 2025 EPS Estimate After Tariff Impact Deutsche Bank slashed its 2025 S&P 500 EPS estimate to $240 (from $282) due to tariffs’ outsized burden on U.S. companies. The S&P 500 index could rally to 6,150 if trade tensions meaningfully abate. Image: Deutsche Bank Asset Allocation