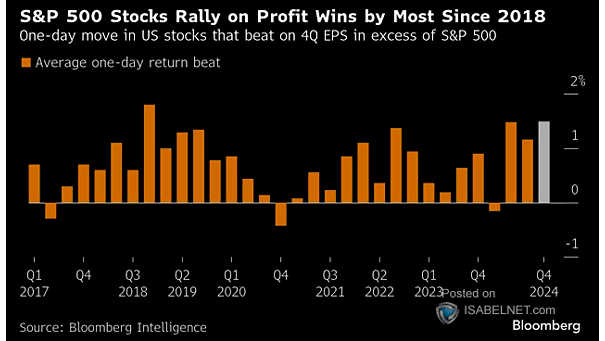

One-Day Move in U.S. Stocks that Beat on 4Q EPS in Excess of S&P 500

One-Day Move in U.S. Stocks that Beat on 4Q EPS in Excess of S&P 500 The market’s positive response to earnings beats, despite uncertainties surrounding Trump’s policies and the Fed’s direction, suggests that strong corporate performance is outweighing other factors in driving investor sentiment. Image: Bloomberg