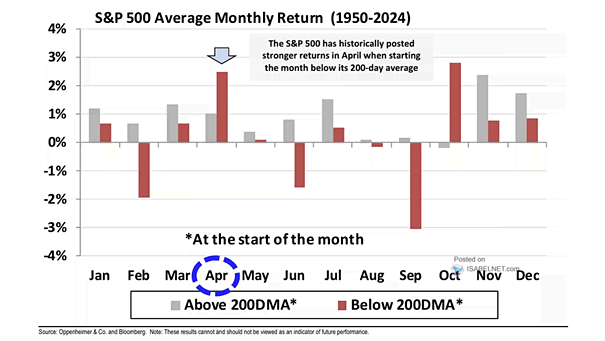

S&P 500 Average Monthly Return Above and Below 200-Day Moving Average

S&P 500 Average Monthly Return Above and Below 200-Day Moving Average Historically, the S&P 500 has performed well in April, averaging gains of over 2% since 1950 when starting below its 200-day moving average. Image: Oppenheimer & Co. Inc. and Bloomberg