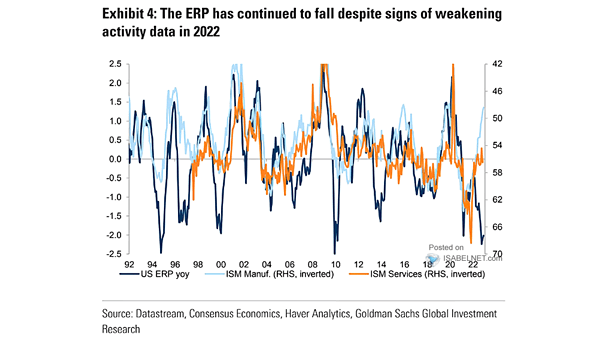

U.S. Equity Risk Premium vs. ISM Manufacturing and ISM Services

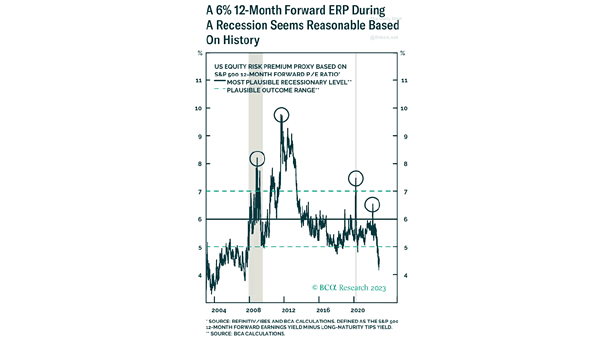

U.S. Equity Risk Premium vs. ISM Manufacturing and ISM Services The equity risk premium is likely to rise if a U.S. recession occurs this year. Image: Goldman Sachs Global Investment Research