Why Warren Buffett Says That Stocks Are Generally Better Than Bonds?

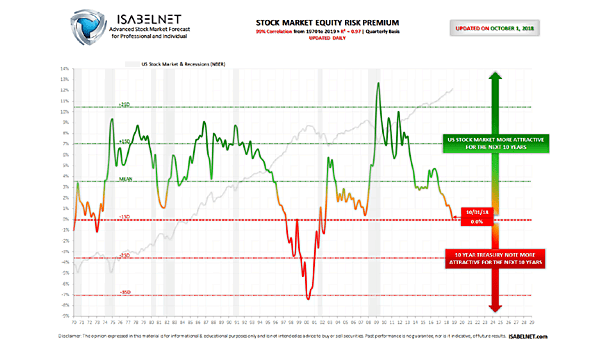

Why Warren Buffett says that stocks are generally better than bonds? Our equity risk premium model shows when the US stock market return for the next 10 years is more or less attractive than the 10-Year Treasury Note. Since 1970, the 10-year Treasury Note was less attractive than the US stock market over a 10-year…