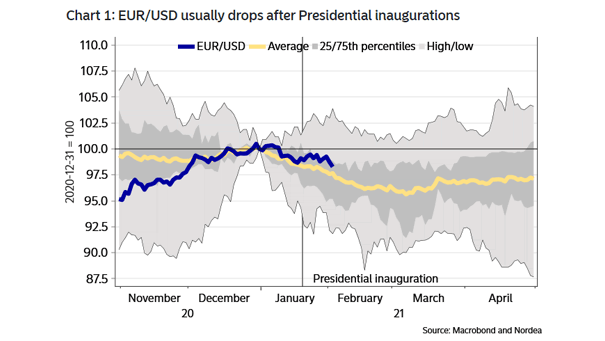

Euro to U.S. Dollar (EUR/USD) After U.S. Presidential Inaugurations

Euro to U.S. Dollar (EUR/USD) After U.S. Presidential Inaugurations In recent history, the EUR/USD tends to drop on average after U.S. Presidential inaugurations. Image: Nordea and Macrobond