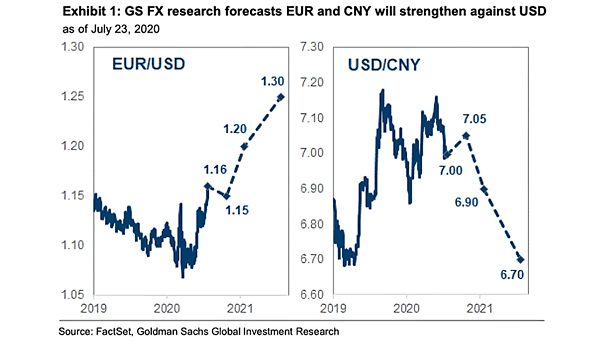

Euro to U.S. Dollar (EUR/USD) and U.S. Dollar to China Yuan (USD/CNY)

Euro to U.S. Dollar (EUR/USD) and U.S. Dollar to China Yuan (USD/CNY) According to Goldman Sachs, the U.S. dollar remains overvalued despite the recent selloff, and offers poor fundamentals. Image: Goldman Sachs Global Investment Research