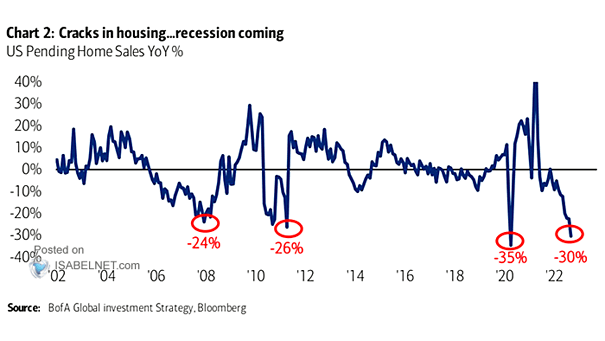

Housing Market – U.S. Pending Home Sales

Housing Market – U.S. Pending Home Sales Recession is coming in the United States. U.S. pending home sales, down 30% from a year ago, are a good leading indicator of the housing market. Image: BofA Global Investment Strategy