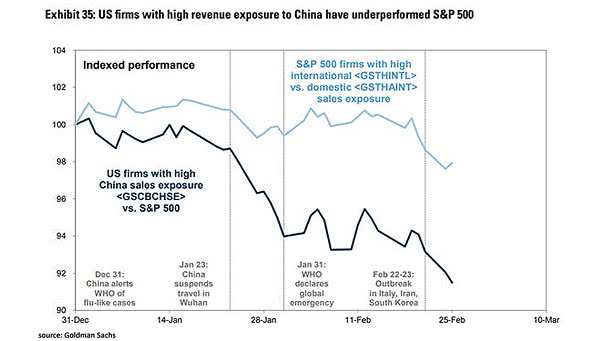

U.S. Firms with High China Sales Exposure vs. S&P 500

U.S. Firms with High China Sales Exposure vs. S&P 500 Chart showing that U.S. stocks with high revenue exposure to China have suffered greater losses. Image: Goldman Sachs Global Investment Research