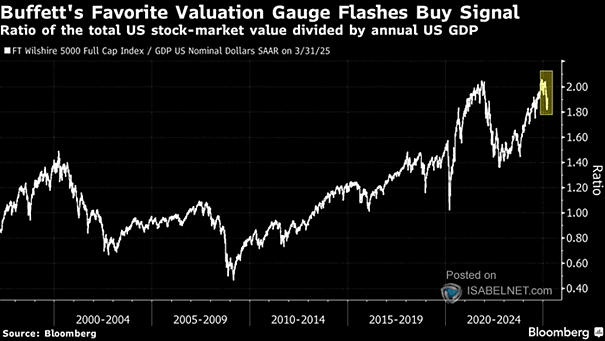

Valuation – The Buffett Indicator

Valuation – The Buffett Indicator Although the Buffett Indicator has fallen from record highs, making U.S. stocks appear more attractive, it still sits well above its historical average and past market lows. Image: Bloomberg