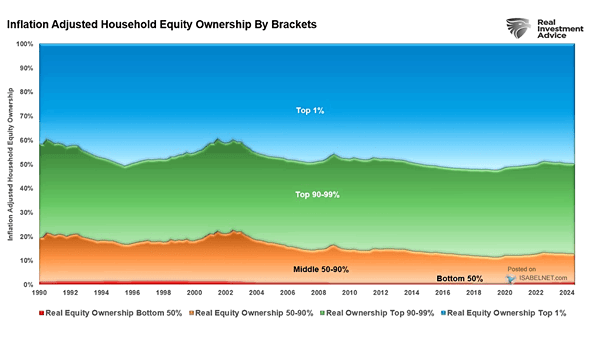

Inequality – Inflation Adjusted Household Equity Ownership by Brackets

Inequality – Inflation Adjusted Household Equity Ownership by Brackets Wealth inequality in the U.S. may be further exacerbated by the current stock market ownership structure, where 88% of household equity is controlled by just the top 10% of income earners. Image: Real Investment Advice