Investors and Trading Activity in Options

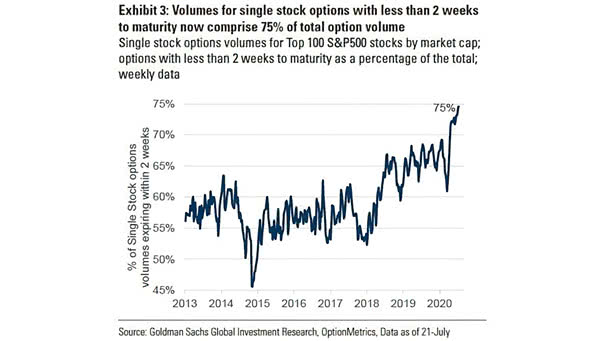

Investors and Trading Activity in Options Investors are trading more actively in options with less than 2 weeks to maturity, driven by better visibility of the catalyst path. Image: Goldman Sachs Global Investment Research