U.S. Monetary Policy and Recession

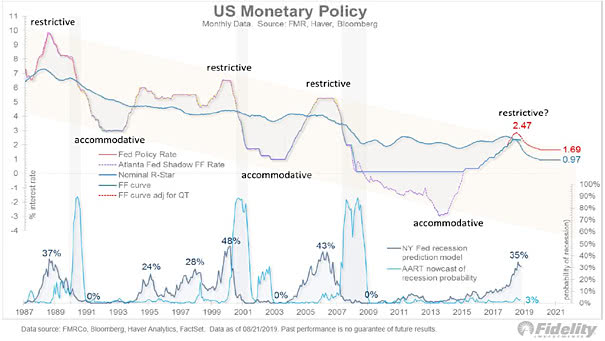

U.S. Monetary Policy and Recession This chart shows the U.S. monetary policy and two recession forecasting models over time (Fed policy rate, Atlanta Fed shadow Fed funds rate, nominal R-Star, Fed funds curve). Image: Fidelity Investments