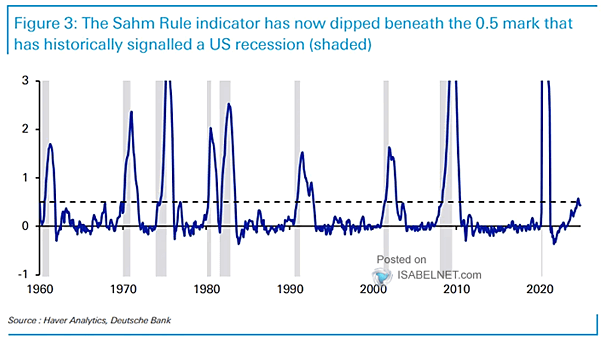

Sahm Rule Recession Indicator – U.S. Unemployment Rate

Sahm Rule Recession Indicator – U.S. Unemployment Rate A drop in the Sahm Rule indicator below 0.5 is a positive sign, as it suggests the rule is not currently signaling a U.S. recession—a generally reassuring indicator for economic health. Image: Bloomberg