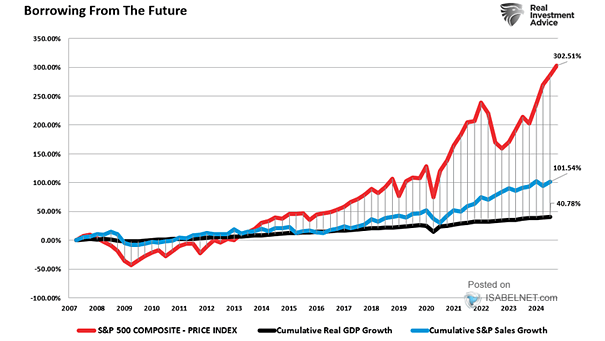

Markets – Cumulative S&P 500 Growth vs. Cumulative Real GDP Growth vs. Cumulative S&P Sales Growth

Markets – Cumulative S&P 500 Growth vs. Cumulative Real GDP Growth vs. Cumulative S&P Sales Growth Since 2007, U.S. stock prices rose 6 times more than U.S. real GDP. Is the disconnect between the stock market and the economy justified? Image: Real Investment Advice