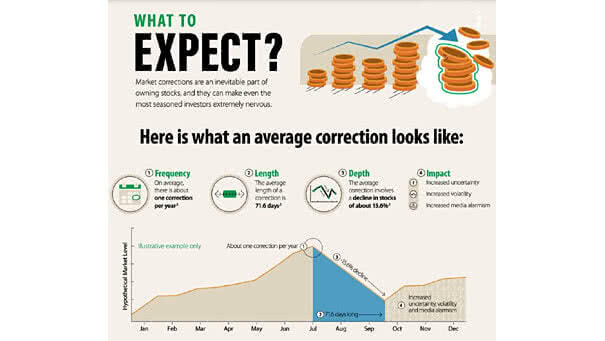

What an Average Stock Market Correction Looks Like?

What An Average Stock Market Correction Looks Like? Stock market corrections are normal. On average, there is one correction per year, during 71.6 days and a decline in stocks of about 15.6% Image: Visual Capitalist