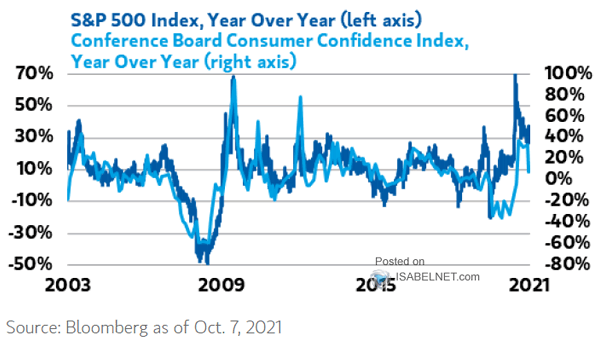

S&P 500 Index vs. Conference Board Consumer Confidence Index

S&P 500 Index vs. Conference Board Consumer Confidence Index The S&P 500 Index and consumer sentiment have diverged since July 2021. Should investors expect market weakness? Image: Morgan Stanley Wealth Management