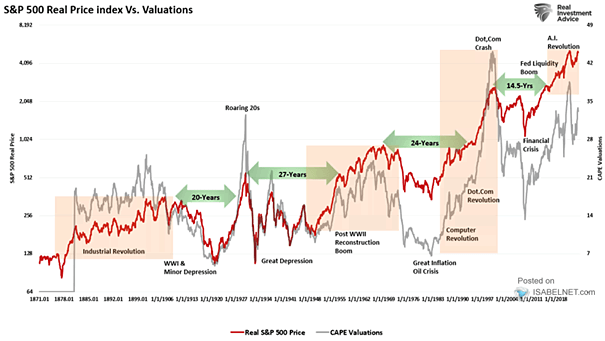

Real S&P 500 vs. Valuations (CAPE)

Real S&P 500 vs. Valuations (CAPE) The timing of your investment journey can significantly impact your future outcomes. Even with the Fed’s interventions, recovering from a bear market can take an extended period after speculative “booms.” Image: Real Investment Advice