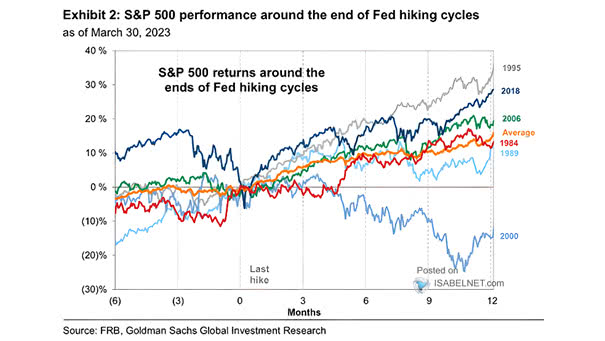

S&P 500 Returns Around the End of Fed Hiking Cycles

S&P 500 Returns Around the End of Fed Hiking Cycles In recent history, U.S. stocks tend to rally if there is no recession following the end of Fed hiking cycles. Image: Goldman Sachs Global Investment Research