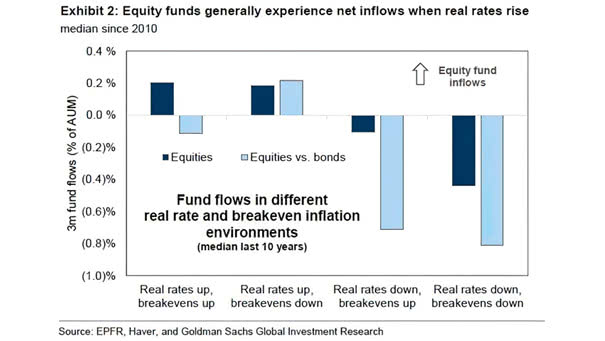

Fund Flows in Different Real Rate and Breakeven Inflation Environments

Fund Flows in Different Real Rate and Breakeven Inflation Environments Equity funds tend to experience net inflows when real rates rise. Image: Goldman Sachs Global Investment Research