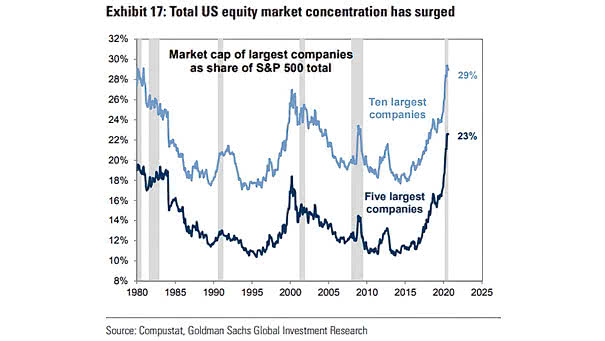

Market Capitalization of Largest Companies as Share of S&P 500 Total

Market Capitalization of Largest Companies as Share of S&P 500 Total Chart showing the record level of concentration in the U.S. equity market. Image: Goldman Sachs Global Investment Research