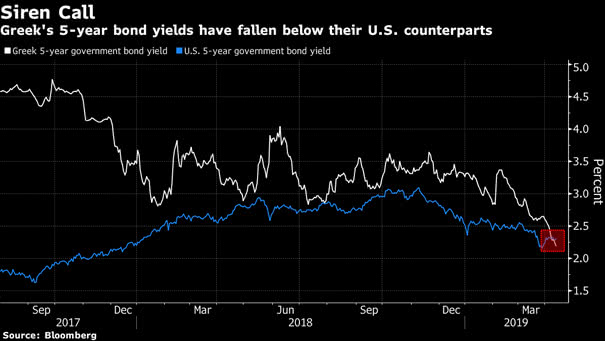

Greek’s 5-Year Bond Yields Have Fallen Below US 5-year Government Bond Yield

Greek’s 5-Year Bond Yields Have Fallen Below US 5-Year Government Bond Yield Which one would you choose? Greek bonds or US counterparts? This is a great example of financial market madness. Mark Twain once said, “History doesn’t repeat itself, but it does rhyme.” That’s true! Greece has spent around half its time in default on its…