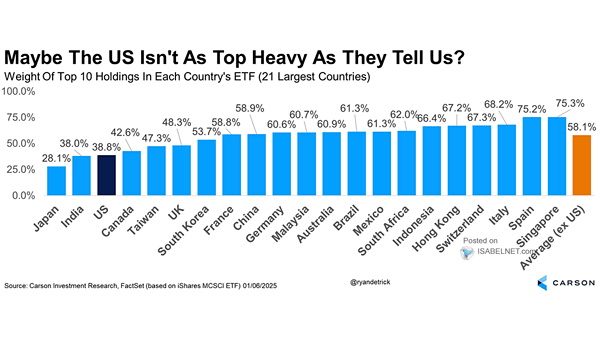

Weight of Top 10 Holdings in Each Country’s ETF

Weight of Top 10 Holdings in Each Country’s ETF Concerns about U.S. stock market concentration, especially among the top 10 stocks, have grown. However, a broader comparison with other major economies suggests that the U.S. market may not be as top-heavy as perceived. Image: Carson Investment Research