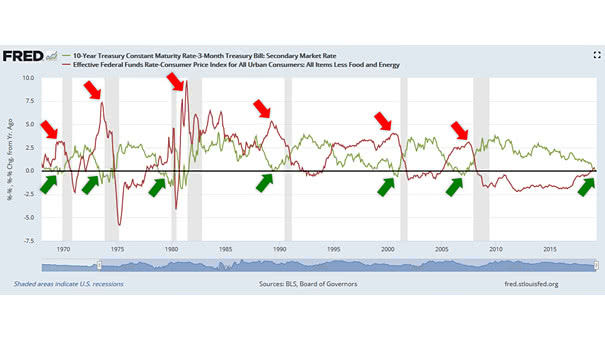

Yield Curve vs. Real Fed Funds Rate

Yield Curve vs. Real Fed Funds Rate In modern history, every recession was preceded by an inverted yield curve and high real interest rates. When an inverted yield curve occurs, short-term interest rates exceed long-term rates. It suggests that the long-term economic outlook is poor and that the yields offered by long-term fixed income securities will…