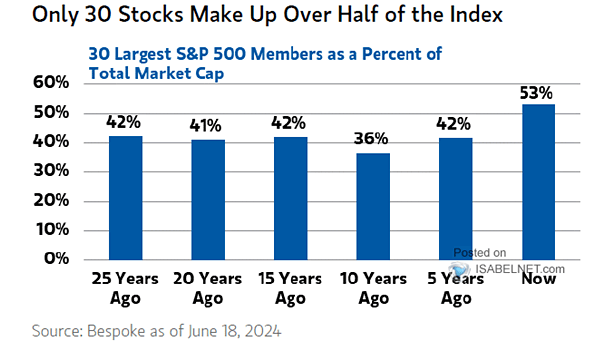

30 Largest Stocks as a Percentage of S&P 500 Market Capitalization

30 Largest Stocks as a Percentage of S&P 500 Market Capitalization The 30 largest stocks account for 53% of the S&P 500’s total market capitalization, raising concerns about the index’s concentration and potential risks. Image: Morgan Stanley Wealth Management