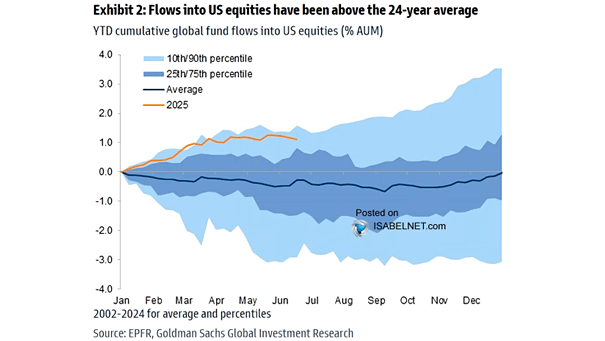

YTD Cumulative Global Fund Flows into U.S. Equities

YTD Cumulative Global Fund Flows into U.S. Equities Despite some volatility and brief periods of outflows, flows into U.S. equities in 2025 have been running above the 24-year average, with projections pointing to a record year for inflows. Image: Goldman Sachs Global Investment Research